Rebound In

Record Time

Most people think it takes seven to ten years to improve lousy credit ... And that's what most banks and lenders want you to think. After all, they make more money in the form of high interest payments off borrowers with bad credit scores. But the truth is that you can have a great credit score in 12 or 24 months, even if you went through a bankruptcy, a foreclosure, a repossession, and a short sale yesterday! Even if you have dozens of collection accounts on your credit report.

Get the guide!

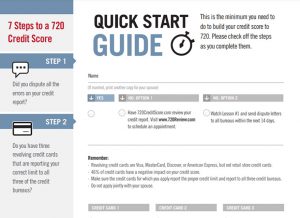

Want a 720 Credit Score?

These 3 Moves Get You There.

You don’t need credit hacks or shady credit repair companies to rebuild your score. These three proven steps can put you on track for a 720 credit score. Get the Three-Day Strategy: A Quickstart Guide for Improving Your Credit Score FAST, and see how thousands are rebuilding their credit score in as little as 12 to 24 months.

About Our Credit Education Course

After studying tens of thousands of credit reports, we identified the quickest and easiest ways to rebuild your credit score drastically. Our credit education course, 7 Steps to a 720 Credit Score, teaches you how to implement these credit strategies in about 15 or 20 minutes a week.

This self-directed course is available to students who have completed Course 1 and Course 2 through Evergreen Financial Counseling. Otherwise, it is available as part of the Credit Rebuilder Program.

Here’s what makes our program different: We aren’t trying to game the system. We don’t do anything unethical. Over the course of three months, you will simply take a few easy action steps so that your score improves naturally.

In just one or two years, you will have a great credit score and:

- Qualify for the best credit cards with low interest rates and great rewards.

- Save thousands of dollars on your car and home loans.

- Refinance existing debt to lower your monthly payments.

- Never again feel worried and ashamed when lenders, landlords, or employees pull your credit report.

Bite-Sized Lessons

Our program consists of a handful of instructional videos that are available through our secure credit portal. The tutorials are ten to fifteen minutes long, and you’ll spend about ten more minutes implementing the simple steps for raising your credit score.

Action Guides

Our videos are accompanied by short, easy-to-follow action guides that are just a couple of pages long. Our action guides are packed with powerful information, like a 153-word letter that you can use to help your score jump 20 to 40 points.

This is Linda

When Linda found us, she had been struggling for as long as she could remember. She had two repossessed cars, a short sale, multiple collection accounts, and a bankruptcy. But that all changed when she found 720 Credit Score. These days, her credit score consistently ranges from 770 to 790, making her qualified for the best interest rates and loans available.

See more peoplejust like you

FAQs

-

When will the credit-education class start?

If you are enrolled through the Credit Rebuilder Program, your class will start immediately. Otherwise, you will be invited to enroll in your free education class, 7 Steps to a 720 Credit Score, 30 days after you have completed the second course through Evergreen Financial Counseling. Be on the lookout for an email with your login information. This email will direct you to a portal that contains all the lessons you need to raise your credit score to 720

-

I don’t have a lot of time... what do you recommend?

Watch the first three videos of the sequence, which are the most important. And remember, you can always upgrade to the Credit Rebuilder Program, and we will do the work for you.

-

Can my wife, kids and family use my login?

Absolutely. Feel free to share your membership with your family.

-

How much work is involved?

Not much. Each video is about 3-8 minutes long. If you do nothing but watch the Welcome Video and implement the action items from the first three videos of the regular series, your credit score will start to increase, and in 12 to 24 months, you will have a 720 credit score (assuming your credit is currently very poor).

Watching the videos and completing the action items from these three videos will take about one hour.

-

What is the difference between this program and credit repair programs?

Credit repair programs charge between $89-$119 per month for their service, which don’t always work. Many of them dispute accurate information and try to game the system, which is illegal and unethical.

7 Steps is credit education that explains how the system works, and how you can earn a great credit score. If you follow the techniques we teach, your credit score will go up every time.

-

What if I have REALLY bad credit as a result of bankruptcy, foreclosure, or some other financial meltdown? Will the program still work?

Absolutely! This system was designed for people with bankruptcy, foreclosure, or other financial problems. A bankruptcy stays on your credit report for ten years, but keep in mind that a credit report and a credit score are not the same things. By going through our program, you will learn how to rebuild your credit score to 720 in as little as 12 to 24 months.

-

Should I buy my credit score before I start the program?

No! Save your money. We prefer that you don’t pull your credit report or buy your credit score until our program directs you to do so. We do not want you to make the mistake of pulling your information from the wrong place. The program will teach you where to get the best credit report and credit score (for free).

Or, when you join the Credit Rebuilder Program we will help you pull your credit report for free.

-

I have no credit score. Will this program still work?

Yes. In fact, the 7 Steps to a 720 Credit Score program works faster with people with no credit. From a lender’s perspective, no credit is just as bad as poor credit, so you should start building your credit using the strategies we suggest in the videos. Your score will go up faster than it would if you had a low credit score.

-

How fast will my credit score go up?

In general, you should have a 720 credit score in 12 to 24 months, but this depends on what your score is right now, and how quickly you can implement the steps. If your score is currently 650, you will have a 720 credit score much faster than if you have a 500.

Regardless, you will start saving money at each credit milestone. For instance, if your score is 550, you can refinance when your score hits 620, and again when it hits 680, and again when it hits 720 and 750.

-

Why is a 720 credit score so important?

A 720 credit score is the lowest score you need to ensure great rates.

-

I need some personal guidance about my credit. Who can I talk to?

When you join 7 Steps to a 720 Credit Score, you will be invited to join our live question and answer sessions. Before each call, you will receive a reminder email containing the call-in information. Members of the Credit Rebuilder Program will receive priority during this monthly calls.

-

What if I didn't take Course 1 and Course 2 through Evergreen?

7 Steps to a 720 Credit Score is a self-directed course available free of charge to students who have completed Courses 1 and 2 through Evergreen Financial Counseling. Otherwise, it is available as part of the Credit Rebuilder Program.

-

When does the course start?

For best results, you should start 7 Steps to a 720 Credit Score as soon as your bankruptcy is discharged (Chapter 7) or confirmed (Chapter 13). As such, Evergreen will enroll you 30 days after you have completed Evergreen’s debt-management course as part of your bankruptcy. This gives your attorney and the bankruptcy courts time to process your bankruptcy.

-

I forgot my login/password. Can you help?

Were you enrolled in 7 Steps to a 720 Credit Score through Evergreen but can’t find your username or password? Please complete this form. After we confirm your enrollment, we will respond with the login credentials.